Introduction to Finance

The finance industry in 2024 is undergoing a significant transformation, driven by technological advancements, economic shifts, and evolving consumer needs. From the rise of AI-powered investment management to the disruption caused by blockchain, financial systems are becoming more accessible, efficient, and innovative. Personal finance is also adapting to the demands of the modern world, with automated tools simplifying budgeting and saving. As the digital landscape evolves, understanding key financial trends and tools is crucial for navigating the future. Whether it’s optimizing credit scores or exploring cryptocurrency, staying informed is key to financial success.

1. Finance

Finance in 2024 is evolving rapidly, with new technologies and strategies influencing everything from personal finance management to investment strategies. Let’s delve into each topic to understand its significance and provide detailed insights.

Top Personal Finance Tips for 2024

In 2024, personal finance is shaped by increasing digitization, inflation concerns, and the need for smarter, automated management. Here are some essential tips:

-

Embrace Financial Automation

Automation simplifies personal finance by managing savings, investments, and bill payments. Tools allow automatic monthly savings and investments, promoting financial growth without much effort.

-

Diversify Investments

Spread risk by investing across asset classes such as stocks, bonds, real estate, and cryptocurrency. Alternative investments, like renewable energy, are also gaining popularity.

-

Prioritize Debt Repayment

Tackle high-interest debt first to avoid escalating interest costs. In 2024, consumers are also increasingly using debt management tools that track and plan repayments efficiently.

-

Emergency Funds

Set up or strengthen an emergency fund to cover unexpected expenses like medical emergencies or job loss.

2. How Blockchain Technology is Disrupting Finance

Blockchain technology is revolutionizing the financial sector, bringing transparency, security, and efficiency to a range of financial services. Below are keyways blockchain is transforming finance:

-

Decentralization and Peer-to-Peer Transactions

Blockchain eliminates intermediaries, reducing costs and speeding up transactions, especially for cross-border payments.

-

Enhanced Security and Fraud Prevention

Blockchain uses cryptographic techniques to secure transactions, making it nearly impossible to alter transaction histories, which reduces fraud risks.

-

Smart Contracts and Automation

Smart contracts on blockchain automatically enforce agreements, streamlining processes like loan approvals and reducing paperwork.

-

Lowering Costs in Remittances and Payments

Blockchain drastically reduces international transfer fees, with cryptocurrencies like Bitcoin offering secure, low-cost alternatives to traditional remittance services.

-

Tokenization of Assets

Blockchain enables the tokenization of assets, making high-value investments accessible to more people by dividing them into smaller tradable units.

3. AI and the Future of Investment Management

Investment management is being transformed by AI, offering data-driven insights, improving decision-making, and enabling new investment opportunities.

-

Data-Driven Investment Decisions

Analyzing vast amounts of data quickly, AI provides investors with better insights into market trends, risks, and opportunities.

-

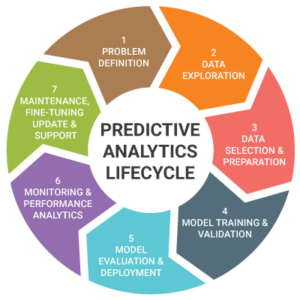

Predictive Analytics for Market Trends

- AI can predict future market trends by analyzing historical data, helping investors anticipate shifts and make proactive decisions.

-

Robo-Advisors and Personalized Investment Strategies

AI-powered robo-advisors offer personalized investment strategies, making professional-grade investment management accessible to individual investors.

-

Portfolio Optimization and Risk Management

- AI optimizes portfolios by balancing risk and return, using real-time data to minimize exposure to risky assets and improve returns.

-

Natural Language Processing (NLP) for Market Sentiment Analysis

AI-driven NLP tools analyze market sentiment from news and social media, offering investors deeper insights into market conditions.

4. Understanding Crypto Wallets: A Beginner’s Guide

Crypto wallets are essential for securely storing, sending, and receiving cryptocurrencies.

1. What is a Crypto Wallet?

A crypto wallet stores private and public keys, which are used to access digital assets on the blockchain. However, the wallet itself doesn’t hold the cryptocurrency; instead, it simply grants access to it on the blockchain.

2. How Do Crypto Wallets Work?

Crypto wallets rely on private keys to authorize transactions, while public keys are used to receive funds. Most importantly, the private key is critical for maintaining control over assets.

3. Types of Crypto Wallets

- Hot Wallets (Online Wallets): Convenient for frequent transactions but more vulnerable to hacks.

- Cold Wallets (Offline Wallets): More secure and ideal for long-term storage of large amounts of cryptocurrency.

4. Security Considerations for Crypto Wallets

Use strong passwords, enable two-factor authentication, and back up your wallet data regularly to ensure security.

9. Credit Scores Explained: What Affects Your Score?

In addition, the length of your credit history is important, contributing 15%. The longer you’ve been using credit, the better it reflects your financial habits, so maintaining older accounts can improve this aspect of your score.

9.1. Key Factors That Affect Your Credit Score

- Payment History (35%): Timely payments boost your score, while late or missed payments can significantly lower it.

- Credit Utilization (30%): Using less than 30% of your available credit is ideal. High balances lower your score.

- Length of Credit History (15%): A longer history of credit use benefits your score.

- New Credit (10%): Frequent new credit applications can harm your score.

- Credit Mix (10%): A variety of credit types can slightly improve your score.

9.2. How to Improve Your Credit Score

- Pay bills on time.

- Keep credit utilization low.

- Avoid opening too many new accounts.

- Monitor your credit report for errors.